Do NFT aggregators stand a chance against NFT marketplaces?

Weekly report with highlights from NFT universe, 4th-11th March 22

NFTmemo by Mattbullish - synthesis of NFT news & investments, interesting projects, overview of NFT activity on Ethereum and Solana blockchains and weekly analysis: do NFT aggregators stand a chance against NFT marketplaces?

What happened - selected topics

The news that stood out - the future of PFP due to consolidation of CryptoPunks and BAYC by Yuga Labs or anonimity based on BAYC KYC requirement, further announcements of NFT infrastructure projects such as marketplaces, integrations such as Gem x LooksRare.

Yuga Labs acquiring the IP of CryptoPunks and Meebits from Larva Labs triggered a wide discussion in the community, announced that commercial rights will go to holders as with BAYC, good summary from @6529

Stripe announced support for NFT sales potentially making it easier to to give birth to new niche NFT marketplaces and released commemorative NFT collection on Nifty Gateway (link)

Music NFTs marketplace under LimeWire brand, some label & artist backing, denomination of assets in USD could be a good step towards mass adoption (link)

NFT aggregator Gem newly supports next to OpenSea also LooksRare, competitor Genie currently supports OpenSea and Rarible (link)

KYC required by BAYC latest initiative for holders triggered discussions about whether retaining anonymity with mainstream NFT brands feasible in long term, majority consensus KYC ok but with reasons why, BAYC poor communication (link)

Investments

Mainly blockchain gaming projects continue to enjoy the attention from VCs from launchpads to infrastructure. What stands out for me is a seed investment into ASM as investments into utility & AI NFTs are not that common.

Selected investments:

Altered State Machine, platform for applying artificial intelligence to the metaverse as NFT, undisclosed investment, seed round (link)

Space Runners, metaverse fashion brand with with digitally wearable NFTs, raises $10M, seed round (link)

Gamepad, Gamefi & metaverse launchpad, raises $2.5M, seed round, $25M valuation (link)

Immutable, L2 for NFTs on Ethereum, raises $200M, $2.5B Valuation (link)

Project watchlist candidates

Gradient is a DeFi lending protocol that enables immediate loans using any NFT as collateral while allowing anyone to earn yield from the NFTs they own

Courtyard is an infrastructure to securely tokenize physical assets into NFTs

Probably Something is a platform of software tools for NFT creators & collectors by PxinDAO, control over the direction of products via NFT ownership, founder write-up

Ethereum & Solana blockchain NFT activity

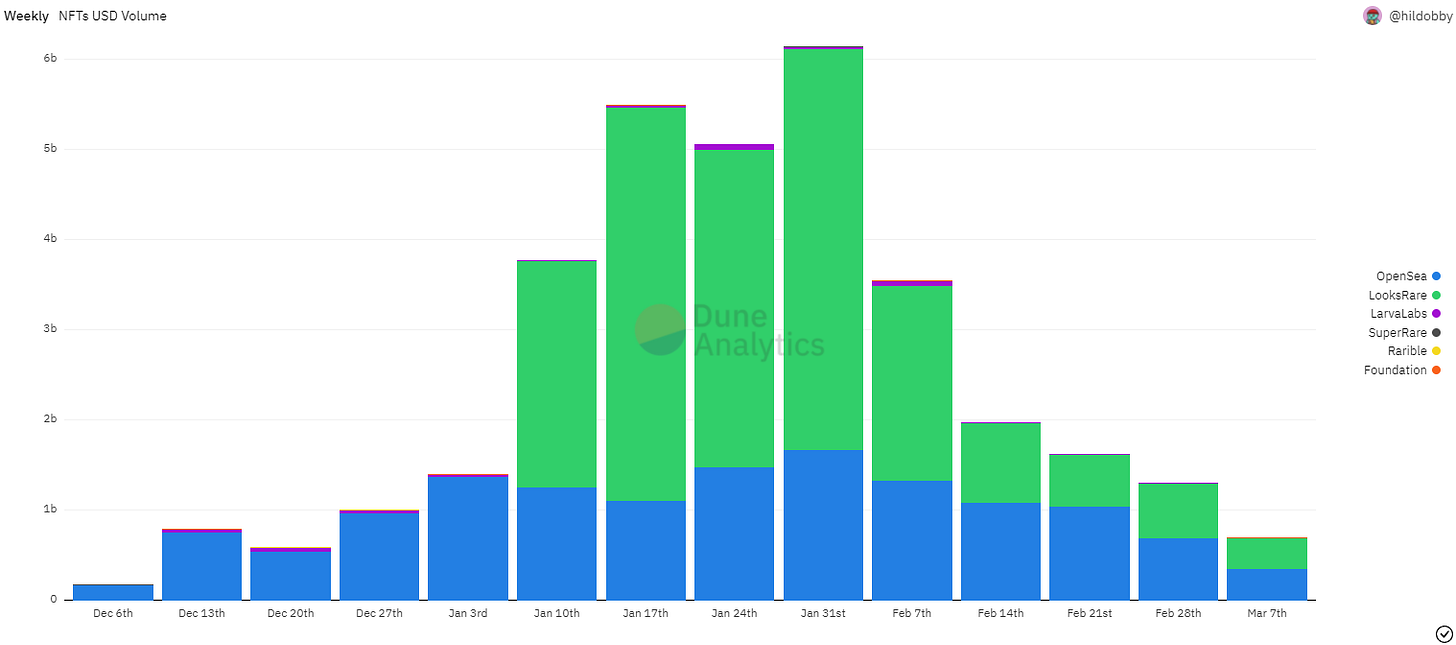

NFT activity on Ethereum based on USD volume continues weekly downtrend, so far the week of 7/3 OpenSea volume $350.81M vs. week of 28/2 $694.83M, currently ~50% decrease (weekend activity not counted in, LooksRare volume ignored due to wash trading). There seems to be rather bearish sentiment prevailing in the community including both general nft market and 1/1 art.

Weekly NFTs trading volume on Ethereum blockchain by marketplace [USD, 3m]

Looking at NFT activity on Solana blockchain DappRadar reports 7d USD volume $106.52M on Magic Eden, a ~20.3% drop compared to previous week and $1.92M on Solanart, a ~22.80% drop, two biggest NFT marketplaces on Solana based on volume.

Do NFT aggregators stand a chance against NFT marketplaces?

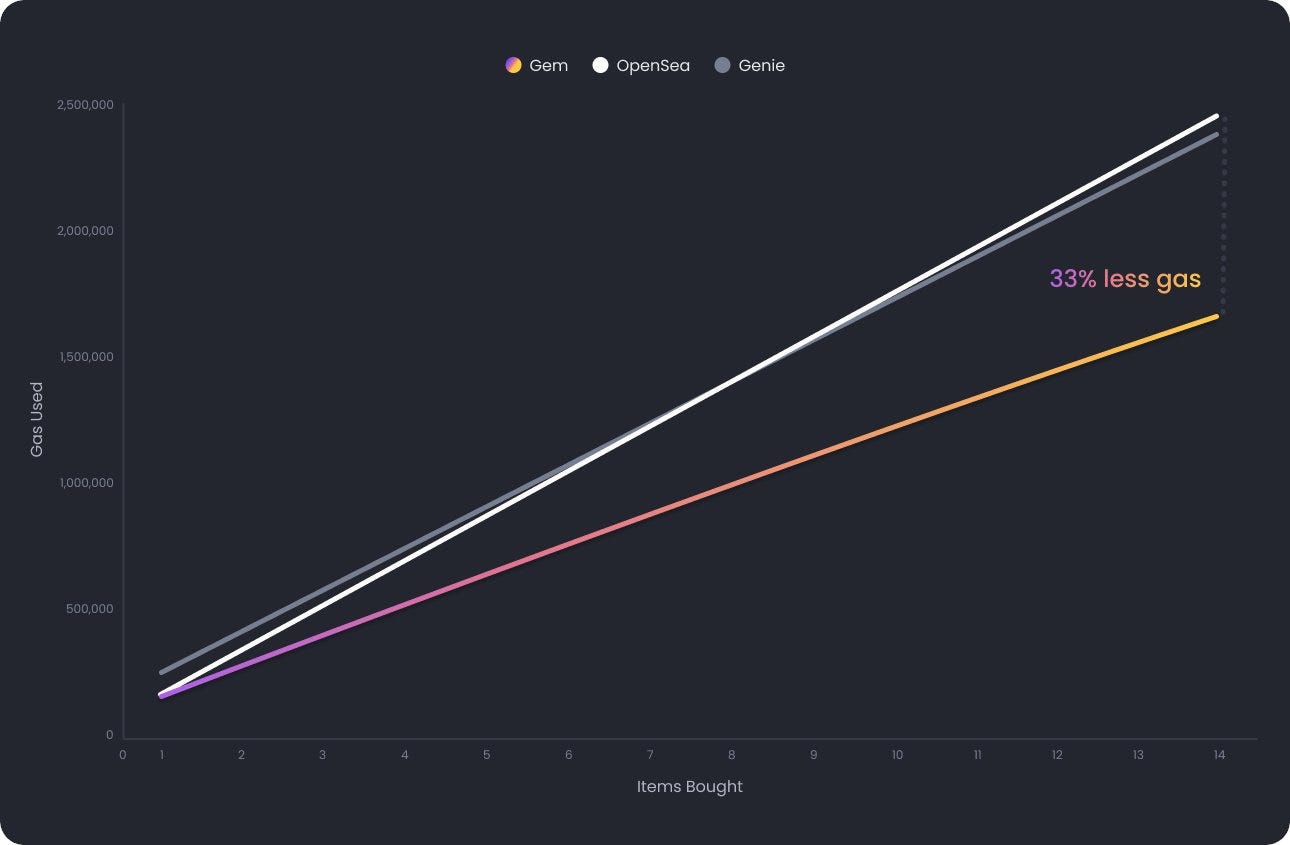

Next to web3-friendly LooksRare and incoming Coinbase NFT, the leading OpenSea NFT marketplace could be met with serious competition also from NFT aggregators. NFT aggregators are relatively new in the space compared to NFT marketplaces, where first NFT aggregator Genie (by @Scott_eth) was launched in Nov´21 with simple propositions of buy/sell multiple NFTs across marketplaces in single transaction. It aggregates Rarible, OpenSea, NFTX and NFT20 marketplaces. Based on NFTX and NFT20 integration it can sell NFT into one of liquidity pools for instant liquidity usually significantly lower under the floor price. Another NFT aggregator Gem (by @vasa_develop) launched on 16th Jan´22 and thanks to better UX and gas savings became fast the dominant player.

Gem is in comparison with OpenSea still a small player with that in terms of USD volume peaked in Feb´22 with $15.16M daily volume and daily average since then would probably be between ~$5-7M. For comparison OpenSea on the same day experienced daily volume of $359.96M i.e. Gem volume was cca ~4.2% of OpenSea.

Assessing digital marketplaces according to web2 optics

Next to trading volumes, no. of transactions and active wallets, it could be interesting also to look back at the optics through which web2 digital platforms can be evaluated. Some approaches could point to 1) whether there is any experience delta, 2) economic advantages by using the platform, 3) edge provided by technology, 4) size of the market opportunity (total available market or TAM could be harder to estimate with ever-changing use cases of NFTs), 5) enhancing features that could also expand the market, 6) frequency of the use case or 7) network effects. Some of these factors I will cover in the next section.

Ideal conditions for digital marketplace would be highly fragmented supplier and buyer base which is very true for NFT space, low friction of supplier sign up or automatically adding fees into the price, which feels like a market standard for a long time. The aggregators enjoy a significant success in the web2 arena, could the same effect eventually spill over into web3?

The case for NFT Aggregators

The main case for NFT aggregators is that they are simply cheaper when buying multiple NFTs. NFT aggregators can be helpful in batch buying (also from different collections) and selling NFTs as they can save significant portion of the gas fees. This could be a strong argument for users using Ethereum blockchain, where gas fees can be substantial.

UI/UX is often quoted factor when discussing NFT marketplaces. With continued mainstream adoption of NFTs, NFT aggregators could provide better UX by simply introducing basket shopping-like experience that we are used to from web2.

One of the potential issues I see is the discoverability of the aggregators themselves. Majority of NFT collectors is currently easily channeled towards e.g. OpenSea because NFT projects are directly linking to their OpenSea profiles. Unless you hear about the aggregator, there are in my opinion not many ways how users can discover them. The lack discoverability options is however also typical for NFTs themselves. There are growing amounts of tools that analyze volumes, price outliers of collections, exploring wallets etc. like Nansen, NFTscoring or tracking specific whale wallets such as Context etc., but other than that NFT collectors are often limited to alpha chats and Twitter. If NFT aggregators would try to leverage this gap and curate the attention, they could become the next go-to-place.

When considering the frequency of use case, it is fair to say that features like “floor sweeps” i.e. buying several NFTs at the floor price are more likely to be used by more experienced NFT collectors or whales. The direct need of a user would arise however in case of buying multiple NFTs. Listing multiple NFTs in one transaction could increase on frequency of use case in case of significant market fragmentation e.g. either with LooksRare growing on popularity or entrance of Coinbase NFT.

Some of interesting features of Gem compared to NFT marketplaces is the option to pay with not just ETH but any ERC20 tokens. You can buy NFT e.g. with tokens of BanklessDAO or Metaverse Index by Indexcoop. Downside is the absence of fiat payments that is often a standard at NFT marketplaces and significantly contributes to mass adoption. Gem pulls out data directly from smart contracts so even if the marketplace is down, it does not affect the potential transaction. Recently Gem rolled out two significant updates yesterday that will contribute to Gem usability, but could also bring significant organic volume to LooksRare (buy/sell activity rewards can be claimed via Gem).

Neither Genie or Gem launched yet there native tokens so some voices could naturally argue, that influx of early adopters can be explained also by hopes of receiving allocations once they do.

Wrap-up

It is unlikely that OpenSea would despite its multiple technical/security issues or centralization narrative loose its first mover advantage in the short run as that is where all the projects and users are for now. However, in case of further segmentation of NFT market NFT aggregators could gain a significant upside and Gem is best positioned to take advantage of that. Both Stripe´s recently announced support of NFT sales & incoming Coinbase NFT marketplace could significantly contribute to that.

Update 16th March 22: Genie granting access to V2, could it mix the cards when it comes to usage of Genie vs. Gem NFT aggregators?

🔗 Want to dig deeper?